जब भी टूटता स्वप्ना ऊ टूटा

ना संभलने का समय मिला

ना भीखर ने का समय

जब भी टूटता स्वप्ना ऊ टूटा

ना संभलने का समय मिला

ना भीखर ने का समय

UPCOMING

PANCHSHEEL ORGANICS

Dividend: Rs 0.80 per share

Dividend Type: Interim

Record Date: 04 Dec 2023

BPCL

Dividend: Rs 21 per share

Dividend Type: Interim

Record Date: 12 Dec 2023

UPCOMING

BONUS ISSUES

DHYAANI TILE&MARBLEZ

Proportion: 9:5

07 Dec 2023

POOJA ENTERTAINMENT

Proportion: 6:1

09 Dec 2023

SONATA SOFTWARE

Proportion: 1:1

12 Dec 2023

SAFARI INDUSTRIES(I)

Proportion: 1:1

12 Dec 2023

UPCOMING

RIGHT ISSUES

ASIT C MEHTA FINSERV

Proportion: 133:200

Record Date: 07 Dec 2023

Offer Price: 151.44 per share

Sonata Software has rallied nearly 117% as compared to 8.4% for the Nifty500, in the last twelve months. It has a Relative Strength Rating of 78 which is a respectable rating, but needs improvement. The EPS Rank of 77 is fair, but needs improvement.

[msiminichart height=480 width=580 osid=3022588 symbol=SONATSOFTW BankdisplayRSLine=true clickable=true ][/msiminichart]

The stock has an Accumulation/Distribution Rating of B. This represents heavy institutional buying over the past 13 weeks. The number of institutional sponsors and shares held by the sponsors, both increased in the most recent quarters.

Today Sonata Software has reclaimed the 21-day moving average after a brief pullback in the recent trading sessions. The stock closed 7% up on a 102.7% greater volume than the 50-day average. Rising stocks often rebound from their 21-day lines as big investors use it as a reference point to add shares to their positions, creating a price support. You may want to keep an eye on the stock for further supporting actions.

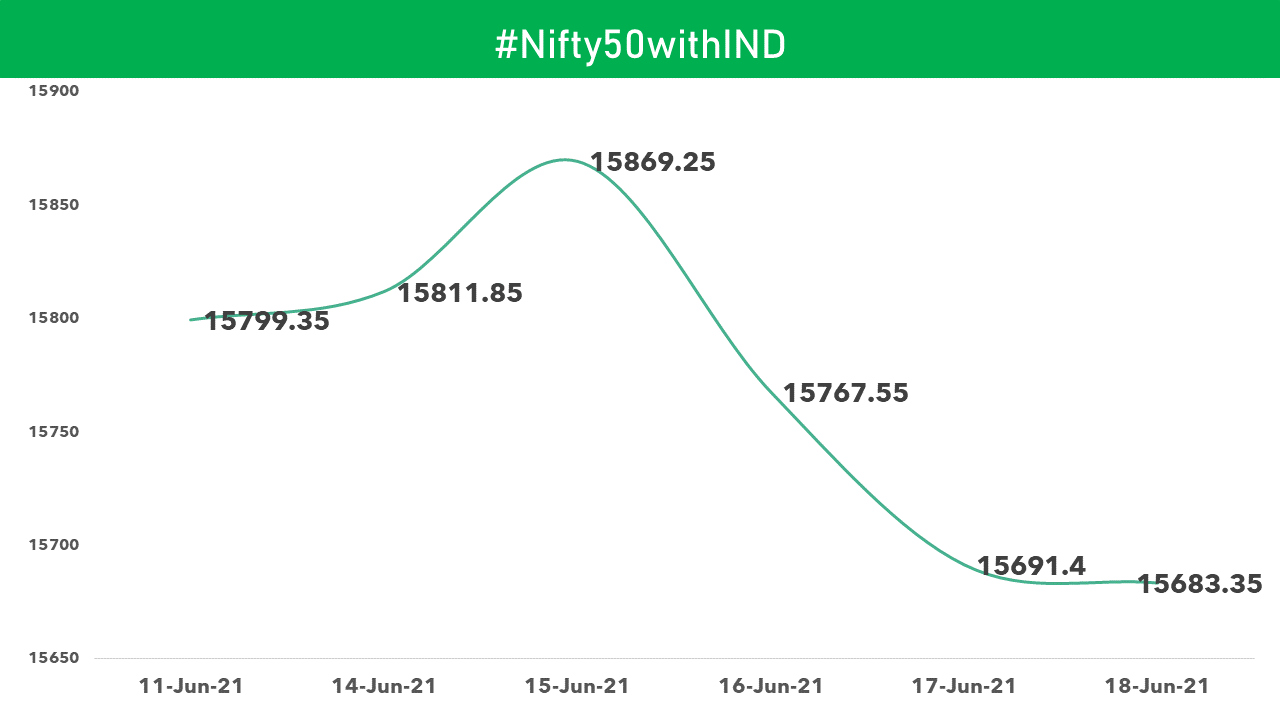

The markets snapped a 4-week gaining streak as factors such as inflation data, volatile crude oil prices, and global cues from Fed Reserve Meet weighed. The week also saw 4 new IPOs, after a long break in the primary markets.

The Nifty started off the week with minor gains on Monday, as sentiments remained upbeat with decline in Covid-19 (lowest since March). The index continued its winning run on Tuesday, after biotech firm Novavax said that its vaccine was found to be 90.4% effective in clinical trials.

However, the stock market saw a modest correction on Wednesday, as firm crude oil prices and negative Asian stocks weighed. Investors were also booking profits, ahead of the US Fed’s Monetary Policystatement. Meanwhile, the CPI inflation came in at 6.3% on May-21, above the RBI’s upper tolerance band of 6%.

The index continued its decline on Thursday after the US Fed raised its inflation outlook. The Fed has also moved up the time frame on which it will next hike interest rates. On the final day of the week, Nifty erased all the intra-day losses and ended flat. The Nifty snapped its 4-week winning streak to register a fall of 0.73% for the last five sessions.

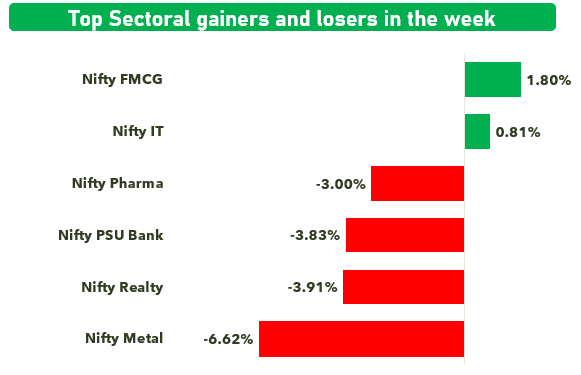

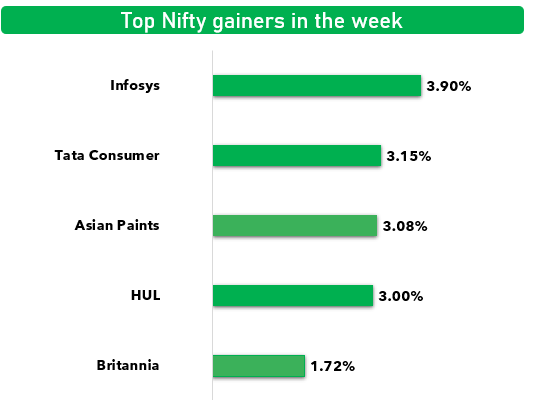

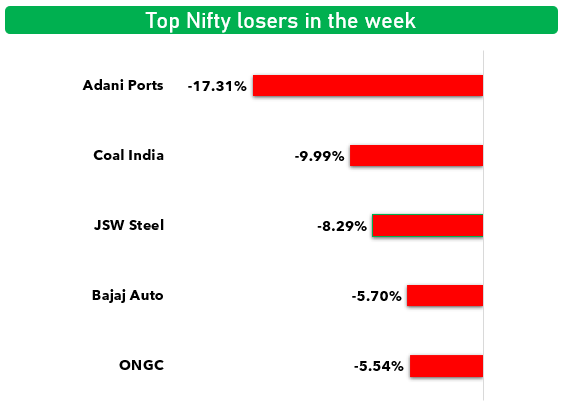

Top gainers and losers

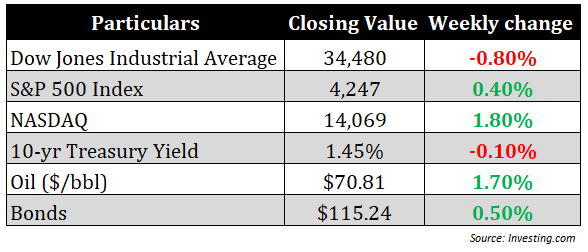

Here is a quick recap of the market moving developments:

Check out our other analysis on important market developments!

The index remained largely unchanged over the first two days of the week, as investors took stock of a host of economic data pointing to labor shortages in the U.S. economy amid recovery. Markets were also digesting the news around a lower trade deficit.

The S&P 500 fell on Wednesday, as investors turned cautious ahead of important inflation data that was to be released later in the day. There were concerns that the Fed Reserve may tighten its dovish monetary policy to combat higher inflation.

U.S. stocks rose on Thursday, with the S&P 500hitting a record high, as economic data appeared to support the Fed’s stance that the current wave of higher inflation will be temporary. The Labor Department said its consumer price index increased 0.6% in May after surging 0.8% in April. On Friday, the index ended at a fresh high, taking its winning streak for the third straight week. Fresh data showed that consumer sentiment in the U.S. rose in early June while inflation expectations eased.

Weekly US market stats

Let’s see the major developments during the week:

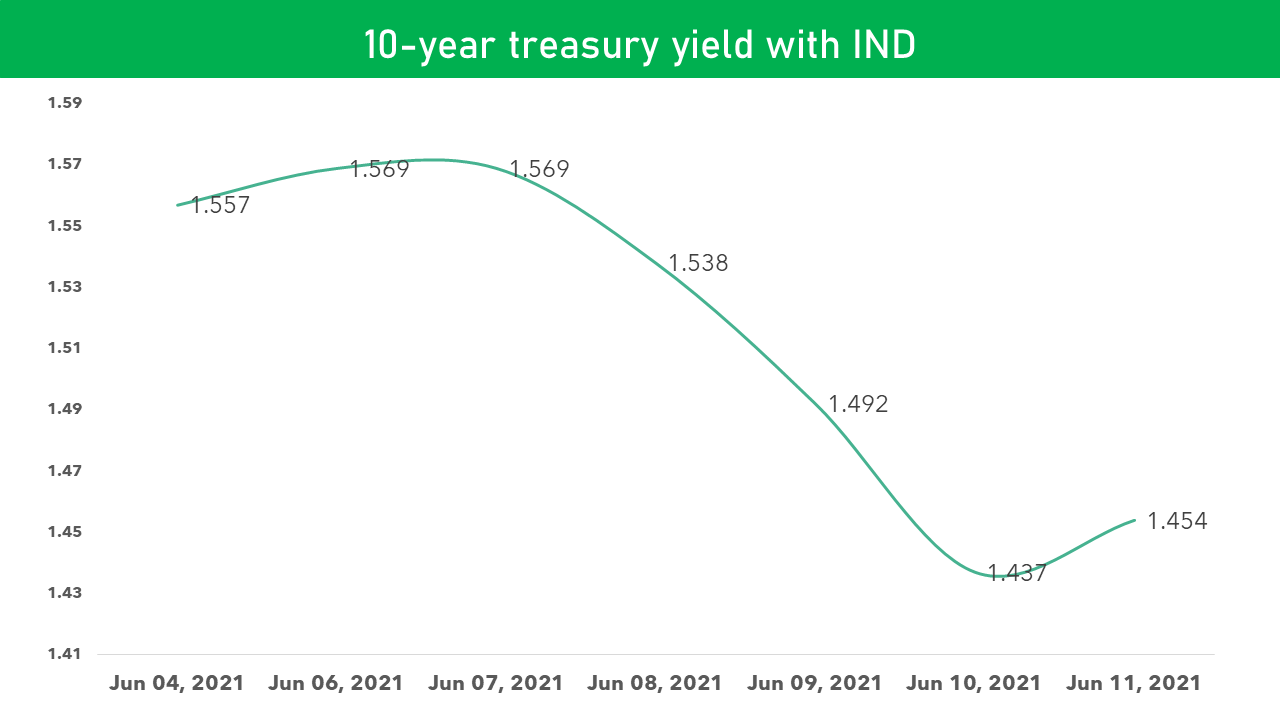

US Treasury yields ease: US Treasury Yields eased during the week after data showed US inflation was not rising wildly as the economy reopens. Interest rates and inflation seemed to continue to be on investors’ radars. The yield on the benchmark 10-year U.S. Treasury note declined through the week after recent assurances from Fed that they would keep monetary policy highly accommodative and that the recent spike in inflation would prove temporary.

All eyes on Fed next week: Last week, the Fed reassured that the central bank would be able to deal with rising inflation without derailing the economic recovery in the US. The PCE (Personal Consumption Expenditure) index climbed to 3.6% in April from a year earlier. This is the highest level since 2008, much higher than the Federal Reserve’s 2% target. The investors will be closely monitoring the developments of the Federal Reserve meeting on June 15 and 16.

Check out our other analysis on important market developments!

Indian weekly market wrap: The markets saw another interesting week, with factors such as declining Covid-19 cases across the country, momentum in vaccination drive, favorable global cues such as declining treasury yields boosting investor sentiments.

RBI policy update: Repo rate, inflation, growth, liquidity and more: The RBI’s Monetary Policy Committee (MPC) has kept the repo rate unchanged at 4% in its bi-monthly policy meeting held today. The reverse repo rate too stands unchanged at 3.35%. Repo rate is the rate at which the RBI lends to commercial banks, and reverse repo is the rate at which it borrows from them.

Why should you add international stocks to your portfolio? Adding international stocks to your portfolio can give you immense advantages such as diversification benefits, and additional currency return due to depreciation of the rupee.

Now a day everyone can talk about a share market every talk about IPO bond debentures .. talk about share market are like 2008 bubble same people talk old story of stock market few year ago you can invest few amount now a day how much amount you can earn and talking power of compounding , power of stock market but wait a minute before you come stock market start trading you need same question to ask your self

1. Why you should come in stock market ???

Please no need to give a foolish answer like for make money ,earn more . Every one come stock market for make money but stock market not give money over night .. you need to patience, courageous, same more financial literacy but it’s mean it’s enough to earn money form stock market Time is most important factor entry right time and exit right time.

Now every one think now a day stock market is bubble but it’s not india is fast growing Country so more development are pending so relax your entry time not a wrong time and your are not late

Every time stock market give best return on tour investment if you invest right place

2. How to get Financial independence via investing in market

Answer is start investing small amount of money every month in market like stock ,mutual fund , ETF , bond , savager gold bond , PPF, EPF etc

Don’t follow blindly same one like rakesh jhunwala radhakrushan damani same tips provinding company , youtuber instagram influence because his risk to reward are different ,holding stock capacity are different , view about stock, Analysis, and most important think is capital ( capital his need no long like 5 yr 10 ,15 yr but about you )

Most of big trader not only invest in stock market his profolio is Diversify like bond, mutual fund, ETF ,PPF ,GOLD ,Real estate etc so that market we crash his backup fund will help for crash

3 How much capital you need for stock trade

Answer is before you invest in stock market you can need to open one demat or trading account Through sebi registered broker. Who you give more facilities like minimum brokager, low AMC, good platform for read easily chart fundamental avout company . If you have all of above think you can start with 500,1000 but you are start atleast 5000

Initial stage you can try to invest best fundamentaly strong stock and technical analysis help you to find right entry point

Fundamental and technical analysis it’s not big think we are learn all about stock market in detail like

Etc . all of think to need to know about market and not only stock market all financial market.. like bonds, debentures, gold,PPF,EPF, etc.

We are learn together to make we financial independent let’s start together…

If you like about it’s follow for more detail

आजवर तुम्हीं पत्र खुपदा लिहिली पधली किंवा वाचकी असला , क़धी व्यक्तिगत कामसाठी तर क़धी व्यक्ति विशेष साठी तर क़धी कार्यालयीन कामा करतीं … असी खुप सारी पत्र आपल्या नज़रें खलुन किंवा आपल्या वाचनातून गेली आहेत व्रूतपत्रे क़यालयी खलिते, असे खुप सारे पत्रतुन प्रकड जलेल्या भावना , अनुभव जीवनशेलि ईदयादि..

पण आपण क़धी स्वतला पत्र लिहिलच नाहीं .. आता बोलाल स्वतला पत्र कश्याला …? काय गरज आहे ..? एवध कशा साठी…? हहे सर्व स्वतचा आवलोक करण्या साठी, स्वतचा मूल्यमापन साठी , स्वतासी स्ववाद करण्या साठी, स्वतः साठी वेल कड़ुन स्वतः ला समजन्या साठी ….

आता बोलल एवध सर्व कड़तोप कशाला…? याने काय साध्य होनार आहे .. ? पण हे बोलन्या आधी स्वतला विचारा आपण स्वतला पूरेसा वेल देतो का …? आणि स्वतची संवाद म्हनजे स्वतशी बोलच अस नाहीं तर स्वतःशी सँवाद म्हणजे

आणि हे सर्व पत्र मार्फ़त स्वतला लिहिताना आपल्या होनारया चूकच्या आठवानी, उनिवाची जनिवा , अगदी शरीरच्या रचने जनार लक्ष सुधा जनिव पूर्वक पत्रात लिहीन त्यावर वेल देउन केले बद्दल सुधा तेवढेच मह्त्व पूर्ण आहे आणि याचि लिखित स्वरुत असलेली पावती म्हणजे हे पत्र …..।

स्वताच विश्लेषण करन … स्वतच्या चुका, ऊनिवा स्वभाव अगदी शरीर रचना सुधा शोधण त्यावर विचार करूँ त्यात सुधार करन … त्या बद्दल करण नवीन कला विद्या भर करण. ईदयादी …

स्वतः वर काम करा स्वतः साठी करा आणि त्या सर्वाची लोख़ित स्वरुपत पावती म्हनून स्वतः एक पत्र लिहित चला स्वतः तले बद्दल स्वताच आनुभवत जा ….

“Whether we are talking about Socks or Stocks, I like buying quality products when they are on sale”

– Warren Buffet

This is Value Investing in a nutshell. This approach is aimed at taking advantage of the irrational behavior of the people in the market.

Suppose you are interested in buying a house to earn rental income out of it. How much price would you be willing to pay?

First of all, let’s see what benefit you will get out of this –

/content-assets/6373323354054d9297a26f8a1dd216c1.png)

For example, you want to hold it for five years.

So, in this case, you would not pay more than the total rent you would earn in these 5 years + expected selling price after five years. Similarly, paying the amount equal to the sum of rental income and sale realization would not make sense because, what would you gain if your total revenue is equal to total expense. So, to arrive a value deal, your purchase price should undoubtedly be less than your total expected income.

As an investment paradigm, value investing refers to the purchase of shares for less than their worth. When we say “value investing”, both the words “value” and “investing” are significant. First, the investors are required to do an accurate valuation and secondly, they should believe in “investing” and not just trading or speculating.

While value investing, you do not focus on the market, i.e., when the market price is high you sell and when it is low, you buy. You must rather focus on the value of the stock. If the value is lesser then the market price, you sell, while if the value is higher than the market price, you buy it. For value investors, a stock is fractional ownership of a company and the value of the stock is the value of the underlying business.

Let us understand the strategies of some well-known value investors –

Benjamin Graham is referred to as the “father of value investing.” He started valuing the stocks at the time of great depression- 1930’s when shares were trading very cheap.

His methods to value the stocks were based on quantitative factors, he just focused on profits, returns, etc. of the company and not on factors that he can’t be sure of like management capability, corporate governance, etc. Some vital contribution of Benjamin Graham in the field of value investing are –

Peter Lynch is one of the best mutual fund managers of the world, who is also considered as one of the most influential personalities in the development of value investing. Some of his greatest investment teachings are-

Warren Edward Buffett is an American business tycoon, investor, speaker and philanthropist. He is the current chairman of Berkshire Hathaway and has a net worth of US$83.1 billion, making him the third-wealthiest person in the world. He is considered as one the most successful investor in the world. His Investment Strategy says-

As per Buffet, investment must be viewed from long term perspective of a businessman. The following things you need to be considered while making your investment decision.

Buffetology (teachings of Warren Buffet) also outlines the importance of intrinsic value. According to him, share prices fluctuate more than its fundamentals. It means in the short run; stock prices move in relation to the emotion of the investor. When the market is surrounded by extreme optimism and shares prices are moving up, many investors enter the market without giving due consideration to its real value.

He has highlighted different methods for valuation like Discounted cash flow, Earning yield, etc.

Many times Warren buffet quoted about the importance of investing in companies run by credible and competent management.

For assessing the management quality,Buffet uses the following criteria

Warrant buffet does not believe in broad diversification. He said “Diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing”. It means broad diversification makes sense for those who don’t know anything, and index funds are the best solution to them. His philosophy is based on the idea that the market rarely offers good companies at a reasonable price. So, concentrating your portfolio in a smaller number of holdings which you find attractive is better than investing in a large number of stocks which you don’t know.

Investing is simple with proper guidance & handholding. No prior Accounting or Financial Knowledge is required in it. Investing is more about qualitative analysis rather than financial number crunching. Please remember – Best Accountants are not the best investors. Thus, investing is more of a psychological activity, that anyone can master.

Charlie Munger is an American Stock investor, the owner and Vice-Chairman of the company called Berkshire Hathaway. Charlie Munger has been one of the most successful investors and a well-known philanthropist. Charlie Munger and Warren Buffet are business partners and are known for their simple and logical philosophies that revolve around business, investment and life in general.

If you can get really good at destroying your own wrong ideas, that is a great gift.

– Charlie Munger

Here, are a few philosophies for stock investment that are used by Charlie Munger:

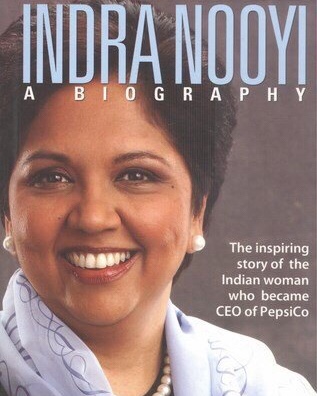

Indra Nooyi is an inspiring figure. She holds out hope for all young women, especially those from developing countries. After all, her journey started in India back in the 1950s and 60s. She hailed from a middle-class family in Chennai and dared to dream big at a time when women’s career choices were still mainly limited to secretary and teacher posts.Indra Nooyi: A Biography chronicles the life of this corporate achiever. Indra Nooyi earned her management degree from IIM, Calcutta and was later accepted at the Yale School of Management..

After completing her Master’s Degree in Public and Private Management in 1980, she joined the Boston Consulting Group. She joined PepsiCo in 1994 and since then, her rise has been meteoric. She became the company’s CFO and led the strategic acquisition of Tropicana and the merger with the Quaker Oats Company. These initiatives added a line of health food products to a company that has traditionally been associated with fun food

The book traces her life from the early years in Chennai, to her struggles to establish herself in the corporate world. It follows her journey from the times she moved to the US, got married and continued her steady rise till her current position as the CEO of the second largest food-and-beverage company in the world.

53 astounding and profitable leadership learnings from the life of India’s most loved, admired and trusted corporate and business leader of all time, including: vision: founder of TCS, Tata chemicals, titan, Tata tea, and many other Tata group compannies ambition: when he took over as Chairman, the Tata group had 14 companies with a combined turnover of17 crores. When he retired, he had raised this to 95 companies with a turnover of over10, 000 crores innovation: he gave expert technical inputs to being on how to improve the performance of their aircraft, which being acknowledge and implemented motivation: aged of 78, just after suffering a heart-attack, flew solo from Karachi to Mumbai on the 50th anniversary of his first flight, solely to inspire his employees of air India reputation: it is said that in the 1960s, when India was in an external debt trap, the world Bank agreed to give India a loan on the condition that not the prime Minister, but JRD Tata would sign on behalf of the nation compassion: initiator of many human Resource best practices in India and globally. In fact the National association of foremen of USA awarded him the ‘international management man Award’ for developing modern and humane industrial Relations in Indian Factories distinction: under JRD’s chairmanship, air India was ranked the best airline in the world based on service quality by a global quality expert. All the above, in stunning detail, along with literally hundreds of other terrifically engaging, inspiring and implementable stories, anecdotes, facts, quotes and tips of JRD as well as other leaders from every era of history and every corner of the globe are in this book to help you Excel in your leadership journey in a structured manne.